What Is A Cataract?

For most people, cataracts are simply a normal part of the aging process that usually develops after an individual reaches 40, the typical age when the proteins of the eye’s lens can start to degrade or lump together. The fogginess resulting from cataracts gradually worsens and keeps light from hitting the retina correctly. This clouding of the eye’s lens leads to vision impairment, and often, total blindness if not detected early and treated properly. Owing to advancements in ocular techniques and technologies, there are many solutions available. Call our team at Focal Point Vision in San Antonio, TX to schedule an appointment, and learn how we can improve your eye health.

Treatment For Cataracts

At Focal Point Vision, our board-certified ophthalmologists develop highly customized treatment plans for individuals with cataracts, depending on what other conditions they may have as well, such as astigmatism, myopia, or hyperopia. Based on your unique vision needs, we offer different packages to address your cataract in conjunction with any refractive errors you may have. This could include basic cataract surgery (typically done with a laser) paired with astigmatism correction, an implantable contact lens, or light-adjustable lens surgery. To learn more, view the details about our various packages or get in touch with our office and speak to a member of our team.

Cataracts FAQ

How do cataracts form?

The majority of cataracts form due to aging or injury, which can change the tissue making up the lens of the eye. However, there are a number of other factors, such as genetic disorders, health problems, other eye conditions, previous eye surgery, and diabetes.

How do cataracts affect your vision?

As cataracts are a cloudy segment of the eye’s natural lens, they often cause blurry vision. As they spread, they will gradually block more and more light from reaching the retina, making it even harder to see. These effects are made especially prominent at night.

When should cataracts be removed?

Cataracts should be removed as soon as you notice them causing impediments to your eyesight. This can be in a number of forms, including excessive fogginess and double vision. If you notice your vision is constantly leaving you feeling disoriented or distracted due to cataracts, it is likely a good idea to schedule an appointment with one of our experts.

Cataract Surgery

Most patients living with cataracts are suitable candidates for traditional cataract surgery as long as they are in good general health. Some kinds of astigmatism could lower the likelihood of the best outcomes, which might, in turn, affect an individual’s suitability for the procedure. Be that as it may, many kinds of astigmatism can possibly be corrected at the same time as cataract surgery. In addition, certain eye problems, like macular degeneration or other retinal diseases, might impact an individual’s suitability for cataract surgery. Sometimes, cataract surgery could be deemed an elective surgery based on the degree of vision obstruction and other circumstances. At Focal Point Vision, we do a complete evaluation of each patient’s ocular health and any previous health issues to establish whether traditional cataract surgery is the best treatment option.

Laser Cataract Surgery

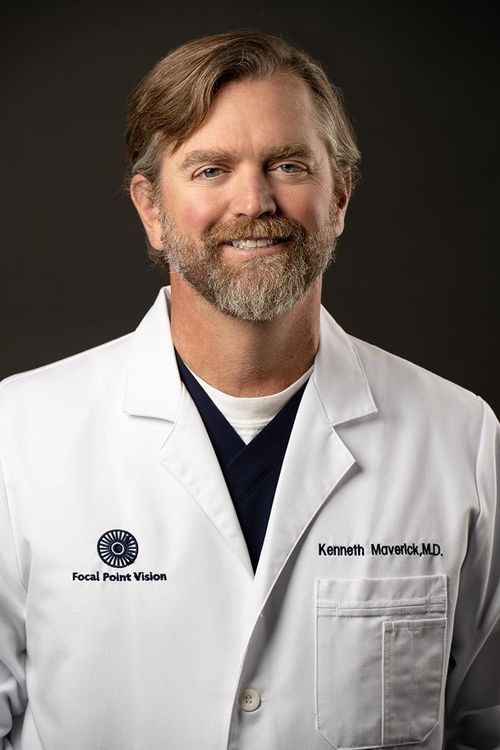

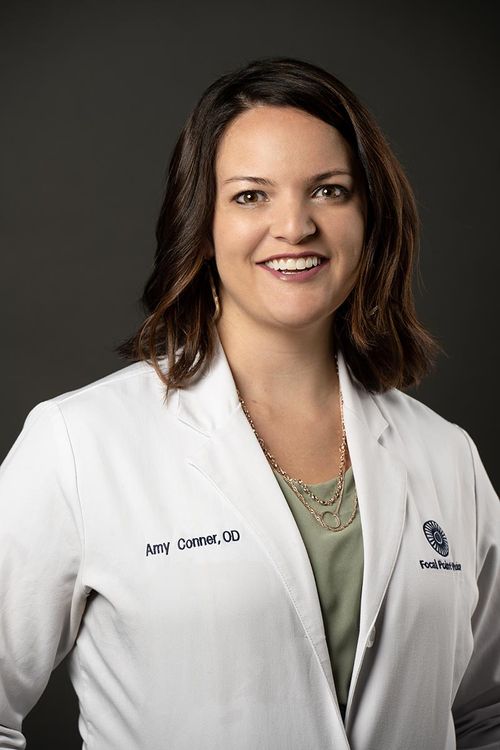

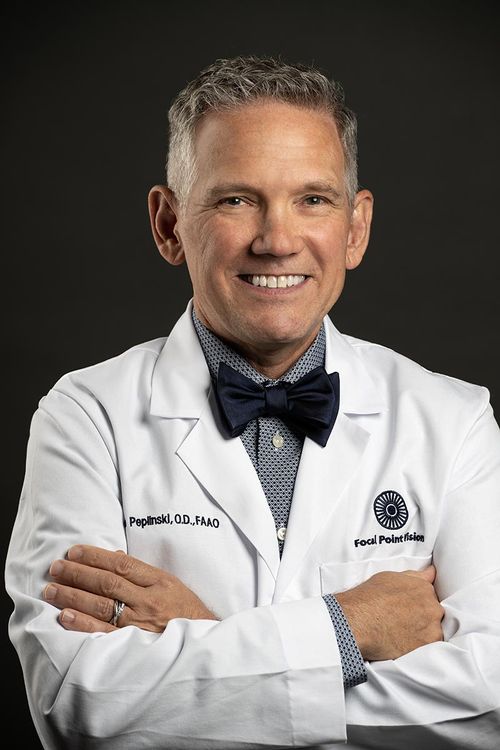

At Focal Point Vision in San Antonio, TX, our board-certified ophthalmologists utilize the LENSAR laser system to expertly remove a cataract and replace the damaged lens with the correct IOL for you.

Hear From Our Cataract Surgeons

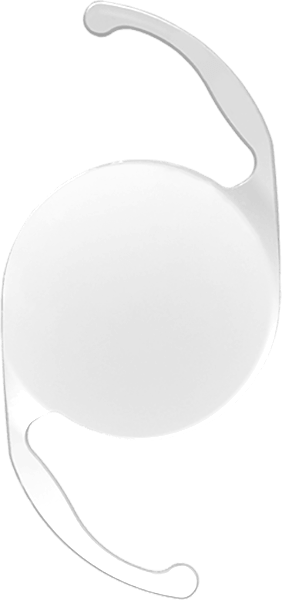

Lens Selection

When planning your cataract surgery, your doctor will discuss the different intraocular lenses available to achieve your visual goals. Our surgeons use the most advanced lens technology available, and will work with you to ensure that you receive the lens best suited to your specific needs.

Trifocal (J&J Symphony)

Lifestyle Vision

Our Lifestyle Vision option is our premier cataract package. Lifestyle Vision offers the greatest versatility in your vision and is designed to help you achieve the greatest independence from glasses possible, to see clearly up close and at a distance. Our surgeons will recommend a High Technology lens best suited to your needs.

Toric (Astigmatism Correcting)

Astigmatism Reduction

This option is designed to reduce the blurring effects of astigmatism. Patients who choose astigmatism reduction will enjoy sharper vision as a result of state-of-the-art intraocular lenses and/or surgical astigmatism reduction techniques specially designed to minimize astigmatism, along with bladeless cataract surgery for appropriate candidates.

Monofocal (Single Vision)

Monofocal (Single Vision)

This option includes standard cataract surgery and a single focus intraocular lens implant. These lenses will improve overall clarity. Glasses will still be needed to optimize vision.

Cataract Surgery Vision Options

Our Recommendation for Your Surgical Plan

LIFESTYLE VISION

The most independence from glasses with the fullest range of focus.

- Bladeless laser cataract surgery (for appropriate candidates)

- Lifestyle lens implant

- Custom astigmatism reduction

(for appropriate candidates) - State-of-the-art imaging and diagnostic testing

- LASIK enhancement, if needed

ASTIGMATISM REDUCTION

Glasses needed for near vision, maximizes distance vision.

- Bladeless laser cataract surgery (for appropriate candidates)

- Custom astigmatism reduction

- State-of-the-art imaging and diagnostic testing

- LASIK enhancement, if needed

STANDARD VISION

Will need glasses to optimize vision, overall clarity improved.

- Manual Cataract Surgery

- Monofocal Intraocular Lens

- Patient is responsible for co-payments, co-insurance and deductibles.